Value-Added Services

Cash Advance

New Vision Telecom is a Premier Introducers of Cash Advance, a service offered by Decimal Factor Limited. We help provide the Business Cash Advance product to hundreds of merchants cross the UK. If you have a card payment facility and are looking for funds to grow your business, complete the form today and our team will contact you to arrange a quote.Read more

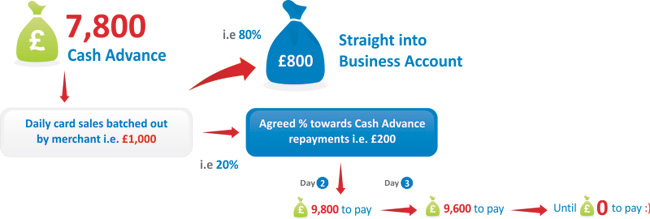

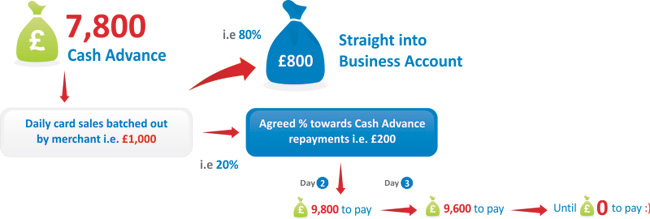

The Business Cash Advance is the most flexible and innovative way to fund in the UK, and works by advancing one months' worth of card revenue (based on your last 12months statements) in a lump sum. The purchase amount is then repaid via an agreed daily % of your card sales being diverted to paying the balance until you have cleared it:

The percentage remains the same whether you have a great day or a bad day sales-wise. For example if you make £1,000 a day and have agreed a 20% split, £800 will go to you and £200 towards repayments. If you make £10 one day, £8 will go to you, £2 towards repayments – providing great flexibility in uncertain times. Over 85% of Decimal Factor's eligible merchants renew, which is testament to its success in today's market!

The percentage remains the same whether you have a great day or a bad day sales-wise. For example if you make £1,000 a day and have agreed a 20% split, £800 will go to you and £200 towards repayments. If you make £10 one day, £8 will go to you, £2 towards repayments – providing great flexibility in uncertain times. Over 85% of Decimal Factor's eligible merchants renew, which is testament to its success in today's market!

Why Cash Advance?

- No Application fee

- 90%+ approval rate

- Unsecured

- Decision within 24 hours

- No impact on credit score

- No set payback times

- Funds available within 10 days

- Repayments in proportion to sales

Typically, funds are used for:

- Additional Working capital

- Equipment & Machinery

- Discounts on bulk purchases

- Renovation and building expansion

- Furniture and fixtures

- Business costs i.e. VAT or Tax bills

- Purchasing new stock

- Advertising and marketing

- Buyout of a business partner

- Opening a new location

- Building a website

FAQs

1. How can Decimal Factor help fund my business needs?

We offer a revolutionary new financing program designed to help you manage your cash needs by providing you with a more responsive alternative to traditional bank lending.

2. How does the program work?

Our products offer a revolutionary way to finance your business operations. The most important thing to remember is that it is not a bank loan. Hence, there is no loan payment books, no dealing with people who do not understand your business, none of the traditional bank hassles, and most of all...no more "nos". The transactions are based upon your future sales. We take a previously agreed upon percentage of your future sales. You can monitor your account on our website. It is as easy as that.

3. How do I know if I qualify?

You must have been in business for more than 12 months, have at least £3500 in credit card transactions per month and meet a few other simple requirements.

4. What can I use the money for?

Most of our customers use the money for business-building needs like adding more seats to their restaurants, advertising or stocking up on seasonal merchandise. Others have used it to buy out a partner or for emergency needs like unforeseen maintenance issues that could interrupt your business.

5. How soon can I get the money?

The average time from receipt of a contract to funding is usually under 10-14 working days.

6. Do I need to change credit-card processors?

You may need to change credit-card processors. It is the unique way we collect the future sales you sold us. Our affiliated processors guarantee to meet-or-beat the transaction rate on your processing needs.

7. What kind of discount do I get if I pay early?

Since this is not a loan, there is no monthly payment schedule. We get paid only when you get paid therefore there is no discount for early payment.

8. Why do you have to review my personal credit?

We use a business-friendly scoring model that blends general economic data, business and guarantor information to assess risk. Considering your personal credit is a part of the process.

9. What qualifies as proof of ownership?

Articles of incorporation, board meeting minutes, a corporate tax return or a business license showing the guarantor's name as an owner are all great proofs of ownership.

10. How often are payments deducted?

We collect from a small percentage of your daily credit card sales.

11. Will I get a monthly statement?

Yes, you will receive a printed monthly statement.

12. What do you mean by "gross volume?"

Gross volume refers to your total receipts from all sources, including cash, credit cards, debit cards and cheques.

*New Vision Telecom is a Premier Introducers of Cash Advance, a service offered by Decimal Factor Limited.

** Decimal Factor operates in association with, and this offer is made through, Elavon Financial Services Limited, a company registered in Ireland. Elavon © 2009 is a trademark Elavon Inc, in the United States and other countries. All rights reserved. Visa®, MasterCard®, JCB®, Maestro®, Diner's® and American Express® ® are trademarks of their respective owners. All rights reserved.

** Decimal Factor operates in association with, and this offer is made through, Elavon Financial Services Limited, a company registered in Ireland. Elavon © 2009 is a trademark Elavon Inc, in the United States and other countries. All rights reserved. Visa®, MasterCard®, JCB®, Maestro®, Diner's® and American Express® ® are trademarks of their respective owners. All rights reserved.